6 June 2023

The RBA continues to address the nation’s inflation challenge with today’s 0.25% increase in the cash rate target, to 4.10%.

The latest inflation figures showed an increase to 6.8% in April, up from 6.3% the previous month, indicating the cost-of-living challenge faced by Australian households.

The ABA encourages those bank customers who are concerned about their financial situation to shop around to find the most suitable deal for their individual needs. Competition in the banking sector is strong and record levels of mortgage refinancing continues.

Banks strongly encourage any customers experiencing financial difficulty to reach out to access bank support services and to do so as early as possible.

Bank support teams are also proactively communicating with those customers at risk. Banks can assist customers by restructuring loans, offering interest only payments, extending the term of a loan and offering payment deferrals.

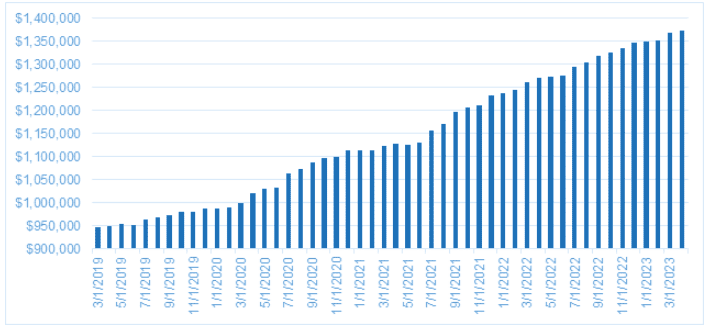

Australians have record levels of savings sitting in deposit and offset accounts while arrears remain at low levels. In April 2023 the value of household deposits on the books of ADIs grew for the 23rd month in a row, to $1.373 trillion.

Figure 1: Deposits held with ADIs, March 2019 – April 2023, $m

Latest news

Australians are under attack from scams, part of a worsening global scams scourge, and all sectors need to ramp up the fight against these criminals, including government, law enforcement, banks, telcos, social media and crypto platforms and individuals.

The ABA welcomes the appointment of Michele Bullock as the new Reserve Bank of Australia (RBA) Governor.

The ABA acknowledges RBA Governor Phillip Lowe’s strong leadership of the central bank during one of Australia’s most turbulent periods, the COVID-19 pandemic.

The Australian Banking Association (ABA) has welcomed the launch of the Federal Government’s National Anti-Scam Centre (NASC), a key government and regulator initiative to help fight the scams scourge.